Product research is a vital initial stage that starts well before the product development process. Successful product research teaches product teams about

- how to shape a product idea

- what similar products there are on the market already

- what is the best way to develop and advertise the product

- whether the product will be a success in its market

The process of product research will also teach you about what customers want and how to adjust your strategy to meet their needs. Surveys are a great tool to get this process started.

But product research does not just happen in the initial stages of product development. Well-seasoned product managers know that the process should be continuous. Businesses that perform best conduct regular product research to stay ahead of their competitors.

Without proper product research your chances of success, like your product decisions, will be random. Learn from the market and your customers to perform data-driven and customer-centric decisions.

Product research methods

The optimal method of gathering product research data will vary depending on whether you are launching a completely new product or a product update.

If you are working on new features for an existing product, your goal is to examine product satisfaction

- customer needs and pain points

- how those needs have changed over time

- how users are adopting new features

Then use this information to decide which initiatives you should prioritize and what to concentrate on within the updates.

If, however, you are developing an entirely new product, you likely won’t yet have a customer base or any historical information about user behavior. You’ll have to concentrate on learning about competitors and the existing market your product will fit into.

Let’s have a look at some ways you can obtain this information.

Surveys

Product surveys are a great way to learn how existing and potential customers feel about your product.

These surveys can include questions about what consumers think of your product

- what frustrates them the most

- what the most needed improvements include

- what their favorite features are, and more.

- You can also gain insights into how these aspects compare to that of your competitors.

Product surveys can be sent via email or link, in-app, in-product, or through your website. This is probably the most convenient, affordable, and effort-efficient way of gathering information to fuel your product research.

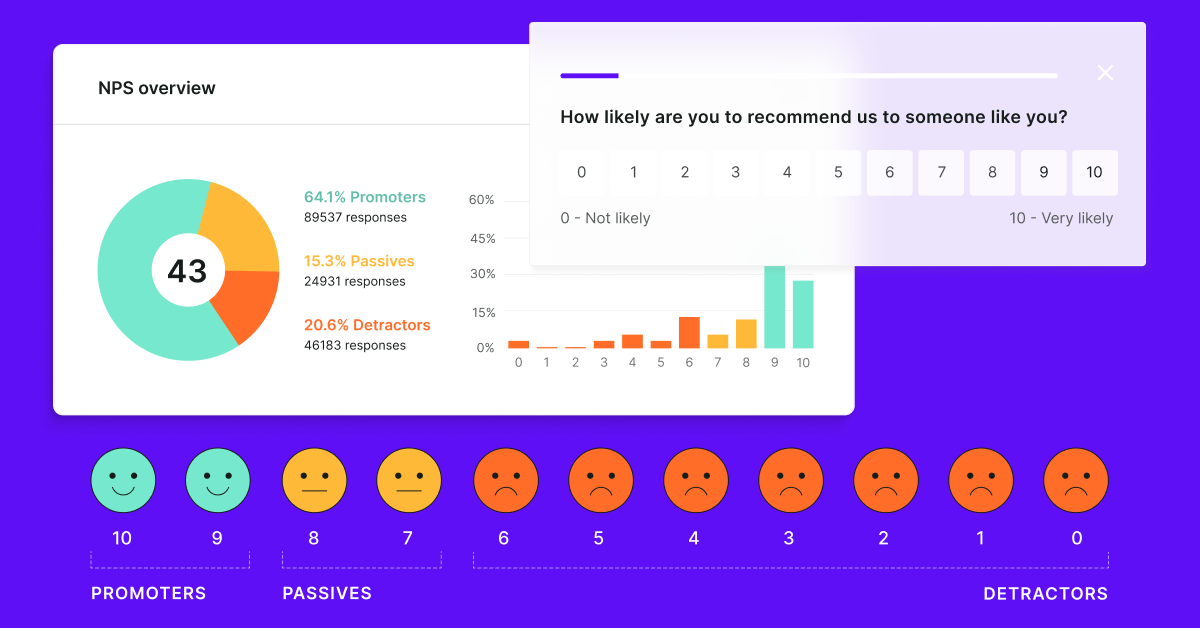

Another kind of survey that can prove useful is a quarterly-basis NPS survey. The open follow-up question can be a great source of new product and feature ideas.

You can also run in-product surveys to see what potential struggles your customers come across. Pair this with session recordings and heatmaps to get a complete picture. Survicate integrates with products like FullStory and SessionCam to facilitate this process.

💡 YOU MAY BE INTERESTED IN: After scenario questionnaire survey template

Customer interviews

At Survicate, we run product research surveys in which we ask customers about their needs. The surveys end with the following question:

“Would you be interested in talking with our team once we work on that feature?”

That way, we can recruit candidates for user interviews and usability testing.

This feedback from sales calls is a great way to get qualitative data on product ideas and concepts.

Lastly, we use Intercom conversations with customers to gather additional feedback and input on silent launches. Respondent attributes identify customers who would be good candidates for product testing.

Concept testing

Concept testing is the process of surveying users about a potential product. You can learn how they feel about it and whether they would be willing to purchase such a product were it available on the market.

This method is very versatile, as it can happen online, over the phone, or through real-life interviews. It can be difficult to obtain a sample of potential clients willing to provide you with feedback, so we recommend using a customer feedback tool to facilitate the process.

Focus groups

You can find focus groups of people who already use a product similar to the one you are thinking of developing. You can enquire about things like an optimal price, the most important features, and features they are missing in their current solution.

This can help you estimate your budget, product development strategy, spending, and profit margins. You can also find out about the qualities of your product that will make it unique and outbid your competitors.

To eliminate bias, choose third-party interviews or online surveys.

Usability testing and demos

Conduct product testing once you create a test model of your product. Show it to potential customers to get their feedback. This can also include having them watch a demo if you don’t yet have a beta version of your idea.

As above, surveys can be a great way of learning about their experience.

When to perform product research

Product research usually happens at these four stages of a product’s (or product update’s) lifecycle.

Before launch

Product research before launch lets you figure out what the competitive market is like, what features are missing but in demand, and what aspects of your product you should prioritize.

Testing and feedback

Once you have a beta version of your product, you can perform testing. This will help you understand how customers perceive your product or its new iterations, what they like and don’t like, and how you can still improve your product.

Soft launch

A soft launch means releasing the product to a part of your customer base to see how it will work in a “real world environment”. At this stage, there is usually still no advertising, so research should focus on usability and value rather than pricing or market fit.

Post-launch

Product research after launch should focus on customers’ behavior, satisfaction, and potential struggles.

Product research process

Product research is essentially studying users to learn their needs and expectations for your product. Start with general information about the competitor landscape and end with detailed data like pricing, subscription plans, and visual design.

Analyze the competitive landscape

A part of product research should always include an analysis of your competitors' products, audiences, and processes.

Even if you are the first to market, you’ll have some indirect competition you need to be aware of or maybe even drive inspiration from. You’ll also likely need to do extra research to ensure there is in fact a demand for your product.

The existence of competitors is not always a bad thing. It at least confirms that the market has been validated. But you will need to come up with ways to differentiate your product and break through the crowd.

Find out how competitors reach their audience and what they do to retain customers for as long as possible.

Evaluate the size of your market

The first step in determining your market size is defining your potential customer. You have to know who you are going to cater to in order to estimate how large that target market is.

We recommend running a demographic survey among users of your competitors.

Market segmentation research

Once you have an idea of who your customers are or are going to be, you can categorize them into segments based on specific characteristics.

This will help you figure out the optimal ways of reaching them, meeting their needs and expectations, understanding struggle points, and learning about their goals.

Product feedback

Test your product before launching it. Use different marketing strategies, pricing options, and distribution methods to learn what conditions your product will thrive in.

We have many product feedback surveys that can help evaluate key aspects of your idea. Most notably, examine your users’ onboarding process…

…and usability of your product.

Price testing

The price is a huge aspect of your product. Of course, you want to be as competitive as possible, but at the same time, you want to make the biggest profits possible.

Use a product pricing survey to learn about demand elasticity and the relationship between product demand and pricing.

Customer research

Learning about your customers or who your customers will be can help you make better product development and advertising decisions.

For example, you may find you have an international audience, in which case it may make sense to make your product or service available in multiple languages.

Find out who your existing customers are to come up with ways to reach new potential clients.

You can also query customers who have recently stopped using your product to learn about ways of preventing churn.

Ask your customers about features they are missing in your product. If they are considering switching to a competitor, you may be able to prevent this by ensuring them you are working on an update.

And always stay on top of customer satisfaction to learn when you need to make changes to your product or its aspects.

Automate your product research

Product research and development should be a continuous process. In the modern world, it’s not enough to develop a great product and call it a day. Use a great product feedback tool to keep gathering customer insights that will drive growth to your business.

With a tool like Survicate, you can automate your surveys to be sent at regular intervals as to reduce your employees’ workload.

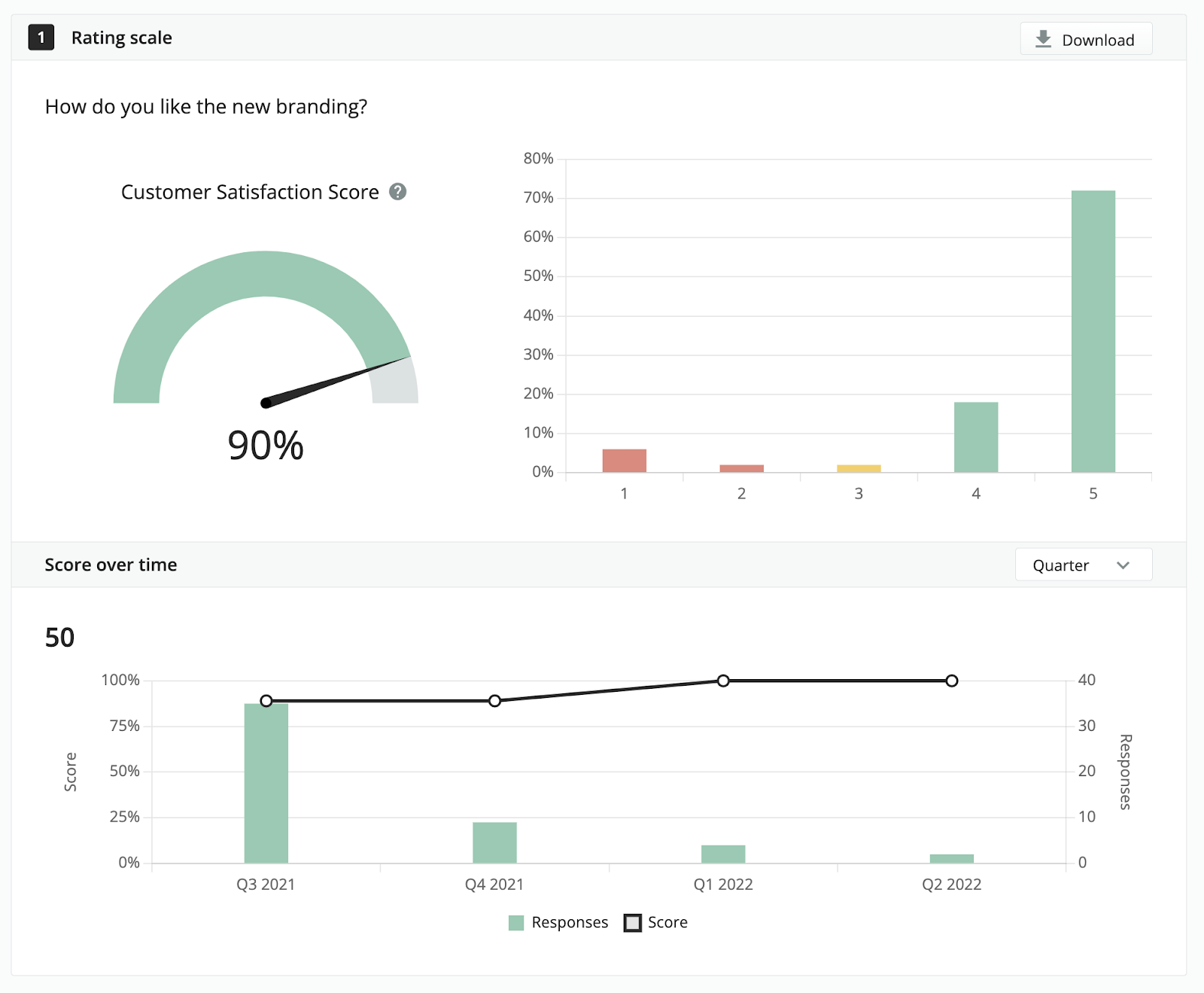

All results are compiled in one place - our dashboard. The analysis panel generates survey reports in real-time.

You can also use ready-made visuals to get information across your entire team.

Segment results

Product research does not end with successfully gathered data. The last step is to use it to fuel product decisions that will realistically improve your product and customer experience, and drive brand growth.

Segmentation of results should be based on business goals and your KPIs. This step ensures data is not wasted and reaches appropriate teams. It will also help plan short-term and long-term goals so you know what data you might need in the future.

For example, tracking user pain points that an update didn’t solve might be helpful in the future when building new features. Documenting what went well during your last product update will help you design your roadmap more efficiently.

Benefits of successful product research

Let’s quickly run through what you can gain through thorough product research.

Identify user needs that your product can solve

Product research will not only help you boost innovation within your product, but it will keep your accuracy in check, too. You’ll be sure that the changes you are implementing actually align with user needs.

Understand the struggles and pain points of your customers

While customer feedback like your CSAT and CES scores are great ways to find pain points, you have to remember they are tied to your customer service and are solicited in nature.

No great business strategy should rely on great customer service to fix issues with the product setup. Make sure you are surveying your customers on the developments they’d like to see. Product research also provides you with behavioral data and insights to build optimal solutions.

Identify potential wins that will differentiate you from the competition

Product research will also help you gain a competitive edge. Researching the market and competitive landscape with help uncover market gaps you can fill with new features or products.

Design modifications in your roadmap to successfully hit KPIs

Successful product research will make prioritization simpler and more efficient. You’ll know what features users want and which ones make them consider leaving you for a competitor.

You can make sure the most important changes are lined up in the near future and your backlog is optimized. The entire team will be aware of which initiatives to work on next to improve customer satisfaction.

Use Survicate to make your product research effective

The best way to learn about your customers’ needs is to understand their behavior in context. Place surveys and feedback widgets in high-traffic visitor points for optimal feedback.

Survicate offers both website and in-product surveys to help you gain insights into customer needs, pain points, and feature ideas. There are over 125 survey templates that go well beyond your usual NPS, CSAT, and CES campaigns.

💡 YOU MAY ALSO BE INTERESTED IN: Product research survey template

Survicate integrations with tools like Slack also make closing the loop an automated process. Set up notifications and communicate with customers immediately after receiving responses.

Wrapping up

Product management centres around product feedback. If you don’t take advantage of this process, you are at risk of missing users' needs and wasting your product development budget.

Understand what will make your customers happy and build a customer-centric product that will break through the competition. Organize your product research with Survicate to get insightful and contextual customer experience data.

The first 25 responses are free. After that, plans start at $65, with each subscription plan unlocking more advanced features. Sign up free and test essential capabilities.

.webp)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.png)

.svg)

.svg)

.png)